What’s Driving Gold to All-Time Highs?

By Jesse Colombo

After more than three years of stagnation, gold has awakened with a vengeance since early-March and has promptly surged by nearly $300 an ounce or 14% to an all-time high $2,330 — a sharp move for a safe-haven asset that has a reputation for its slow and steady trends. Gold’s powerful rally came seemingly out of the blue and has confounded the majority of investors and commentators who have been much more focused on trendy speculative stocks and cryptocurrencies as of late. In this piece, I will explain several of the technical and fundamental factors that are driving gold to all-time highs, what is likely ahead for gold, and how investors can best take advantage of the yellow metal’s resurgence.

A Look at the Technicals

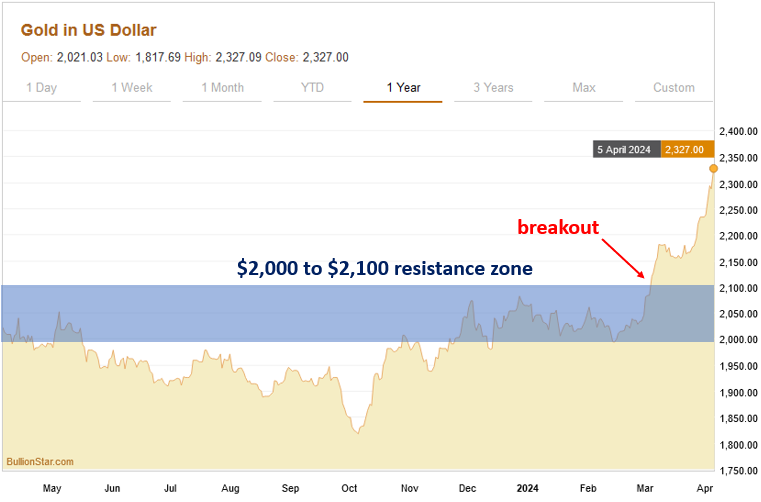

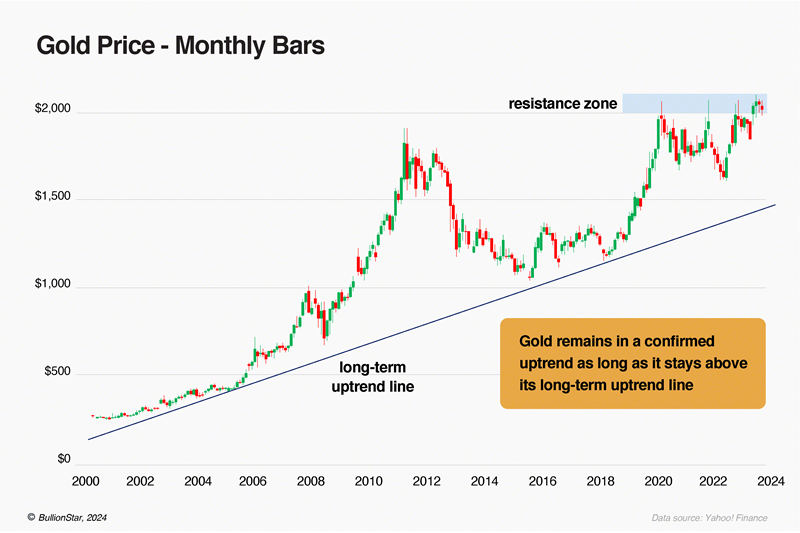

The chart of gold over the past year shows how it suddenly sprang to life over the past month. As I had explained in my last blog post on March 1st, there was an important technical resistance zone from $2,000 to $2,100 that had been acting as a price ceiling for gold since the middle of 2020. Gold’s successful close above that zone signified that a new rally had begun even though the fundamental drivers of it weren’t exactly apparent just yet.

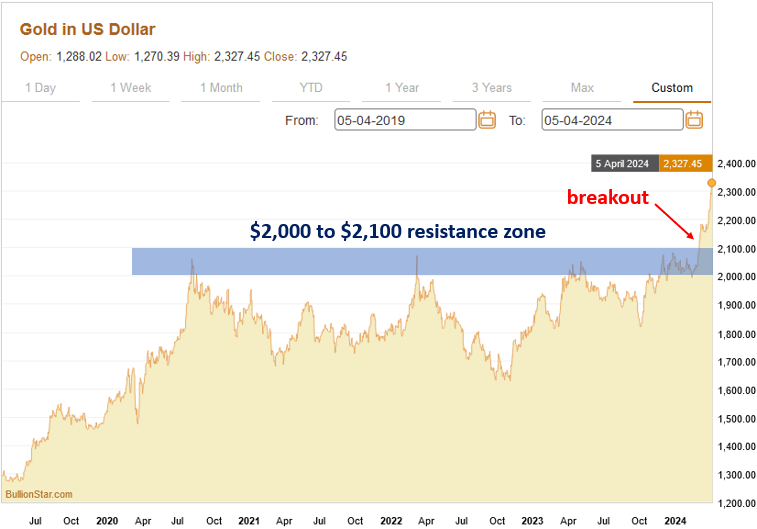

The multi-year gold chart shows the significance of the $2,000 to $2,100 resistance zone and how gold kept bumping its head at that level until it finally pushed through in the past month:

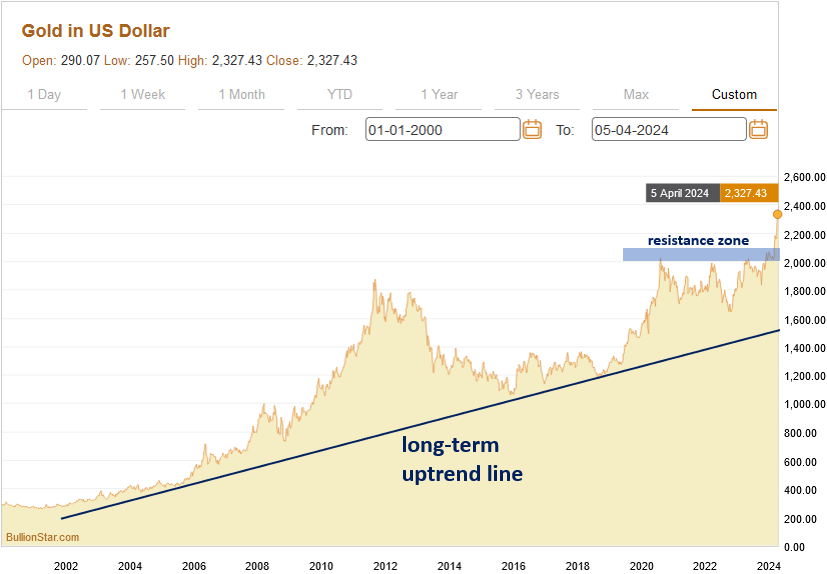

Gold’s multi-decade chart shows that it has been steadily climbing an uptrend line that began in the early-2000s as the U.S. and other countries kicked off an unprecedented debt binge that shows no signs of stopping whatsoever:

Gold is Rising Despite the Strong U.S. Dollar

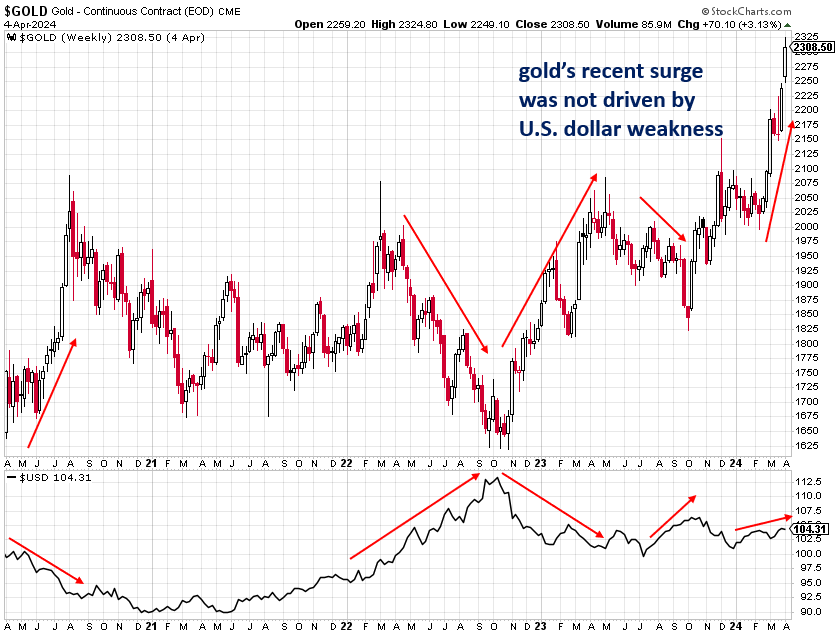

What’s particularly interesting and notable about gold’s surge over the past month is how it has occurred independently of the action in the U.S. dollar. Gold and the U.S. dollar have a long-established inverse relationship, which means that strength in the dollar typically causes weakness in gold, while dollar weakness typically causes the price of gold to rise.

The chart below compares gold (the top chart) to the U.S. Dollar Index (the bottom chart) and shows how action in the dollar often causes an opposite trend in gold. Gold’s recent surge took place while the dollar was trending slightly higher, which is a sign of gold’s strength due to its ability to buck the negative influence of the strengthening dollar.

Mainstream Investors & Journalists Missed Gold’s Rally

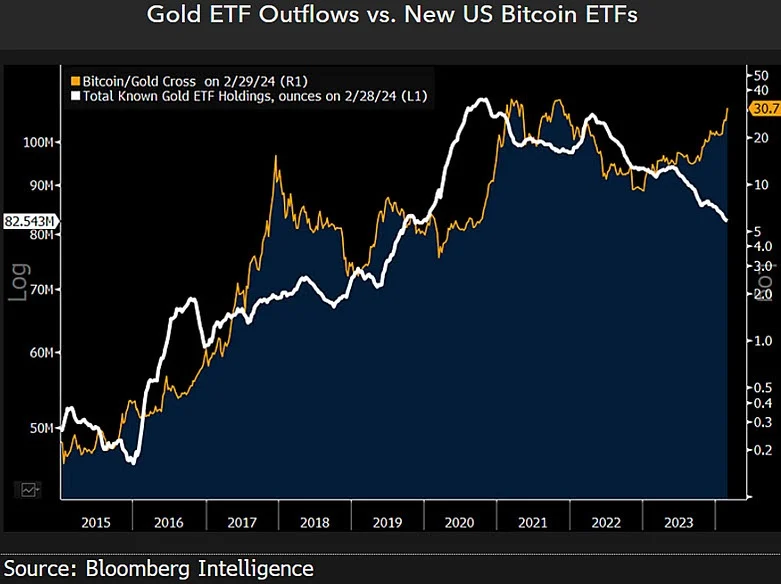

What is also worth noting is how gold’s surprising recent rally has received very little mainstream attention by a press that is much more enamored with hot AI stocks as well as Bitcoin and other cryptocurrencies that have recently benefited from the U.S. government’s approval of a number of Bitcoin exchange-traded funds (ETFs), which has resulted in tremendous inflows from institutional investors and retail investors alike.

As the chart below shows, investors have pulled billions of dollars worth of funds from gold ETFs in order to re-invest in Bitcoin ETFs, which is ironic considering its timing shortly before gold’s liftoff (and is confirmation of contrarian investing principles). The continuation of gold’s bull market will likely lead to funds flowing back into gold ETFs, providing additional fuel for the rally.

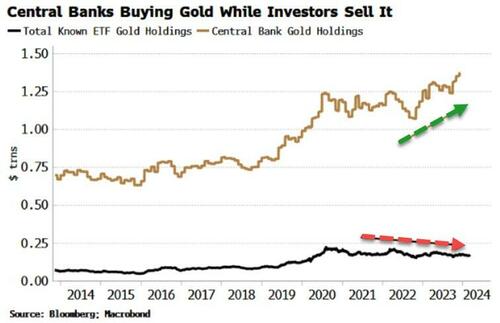

Central Banks Are Steadily Accumulating Gold

Though Western retail investors (who are often considered to be the “dumb money" in the market) have been sleeping on gold before and even during its surge of the past month, central banks — particularly those in Russia, China, Turkey, and India — have been steadily accumulating practically all of the gold that they can get their hands on. According to the World Gold Council, central banks purchased a healthy 1,037.4 metric tons of gold in 2023 in an effort to diversify out of the U.S. dollar and other fiat currencies that are being debased at an alarming rate and into a hard asset with a six-thousand year history as sound money that cannot be printed.

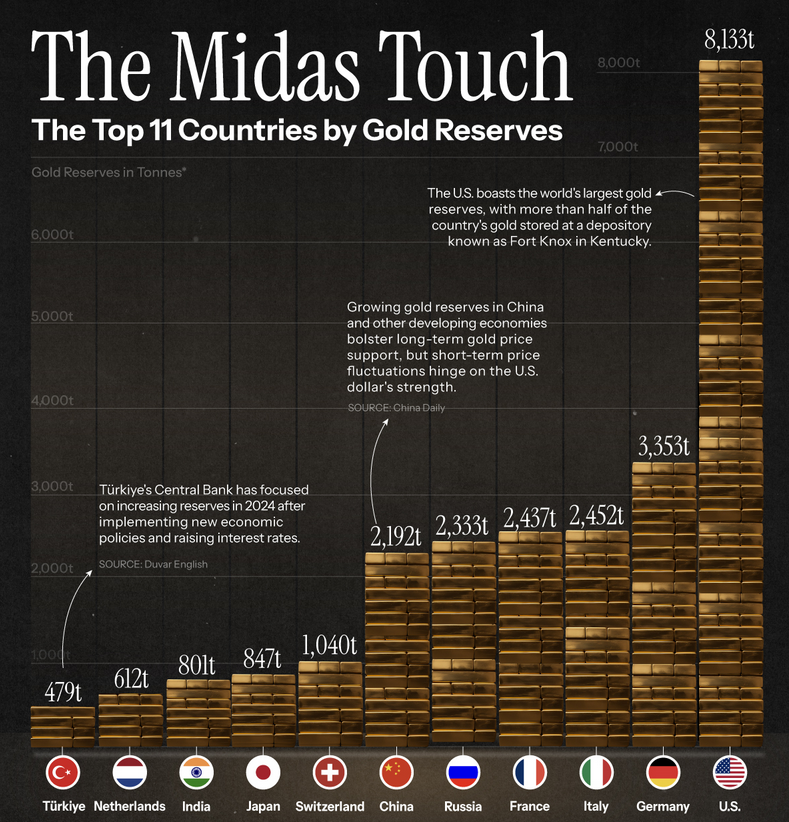

Though virtually all of the world’s currencies have been downgraded to pure fiat or paper currencies that are not backed by gold since 1971, many of those currencies are indirectly and implicitly backstopped by gold due to the large gold reserves held by many countries. For example, the U.S. officially holds 8,133 metric tons of gold, Germany holds 3,353 metric tons, Italy holds 2,452 metric tons, France holds 2,437 metric tons, Russia holds 2,333 metric tons, and China holds 2,192 metric tons of gold. In a serious currency crisis, a country’s gold reserves is likely to be one of its only saving graces, which is why many countries are accumulating gold at such a rapid pace.

Chinese Investors Are Buying Up Gold

Chinese investors who are seeking refuge from the country’s sinking property and stock markets are another important driver of gold’s nascent rally. Starting in the mid-2000s, China’s property and stock markets embarked on a seemingly unstoppable bull market as the country’s economy grew rapidly and the country began to increasingly flex its economic and geopolitical muscles on the world stage. Unfortunately, like Japan in the 1980s and the U.S. in the mid-2000s, China’s asset boom was actually an unsustainable bubble that was driven by copious amounts of debt and reckless speculation.

As all bubbles eventually do, China’s property and stock market bubbles have burst over the past year causing at least hundreds of billions of dollars worth of losses — including $100 billion alone from the country’s property tycoons. As faith in China’s economy and financial markets sinks, investors are turning to the old standby, gold, which has thousands of years of history in China as a superb store of value in good and bad times alike. When complex financial systems and products fail, as they currently are in China, savers and investors appreciate the simplicity and straightforward nature of physical gold. As the famous financier J. P. Morgan once said, “Gold is money. Everything else is credit."

According to the World Gold Council, consumer demand for gold in China increased by a stout 16% in 2023, while demand for gold bars and coins rose by an even more impressive 27%. Retail gold buying in China has been dominated by the younger generations who face a difficult job market and are largely priced out of the country’s unaffordable housing market but find physical gold to be attainable — even if it means buying tiny amounts of it at a time as funds allow. Indeed, one of the most popular gold bullion products among young Chinese are gold beans that weigh as little as one gram and cost approximately 600 yuan (USD$83).

How Inflation is Contributing to Gold’s Recent Rise

Another important factor driving gold’s recent rally is stubbornly high inflation that is not easing as quickly as economists had hoped and may instead be on the verge of a resurgence. Gold is traditionally seen as a hedge against inflation and is very adept at sniffing out rising future inflation rates. U.S. year-over-year inflation — as measured by personal consumption expenditures — increased at a 2.5% rate in February, which caused traders to slightly dial back their expectations for Federal Funds Rate cuts this year.

Though U.S. inflation is still elevated, there is good reason to believe that the Fed will still go through with their plans to cut rates this year, which should prove to be beneficial for the price of gold. According to Bank of America’s commodities strategist Michael Widmer, “The market is interpreting that the Fed is willing to accommodate higher inflation as it cuts rates.”

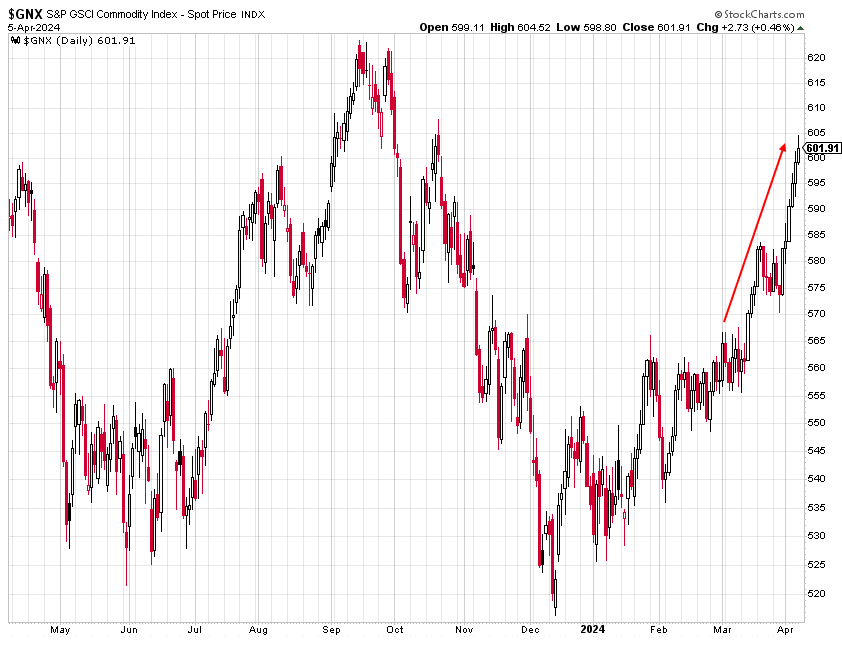

What is worth paying attention to in particular is the sharp surge in commodities prices over the past month, which is likely an indication of higher rates of inflation in the future:

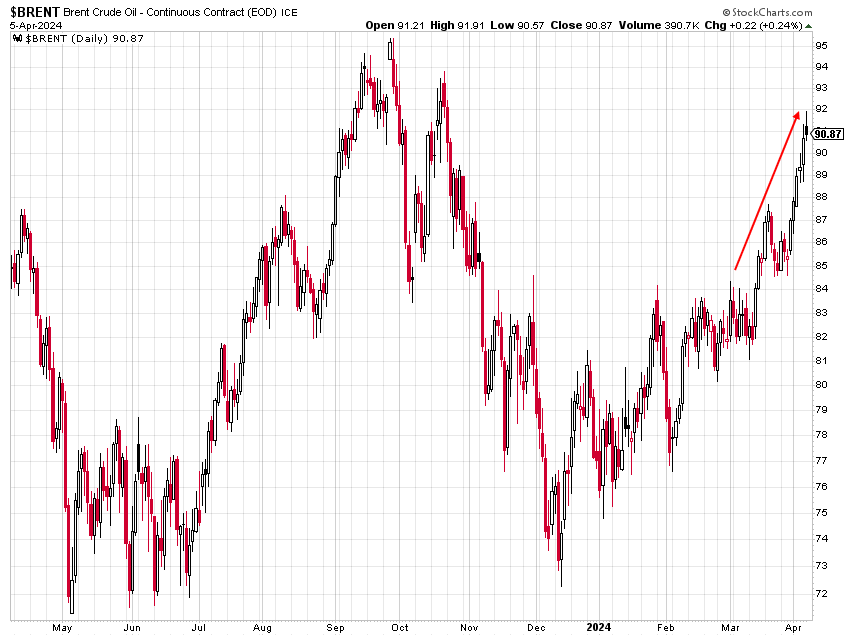

Similarly, crude oil increased by 10% over the past few weeks:

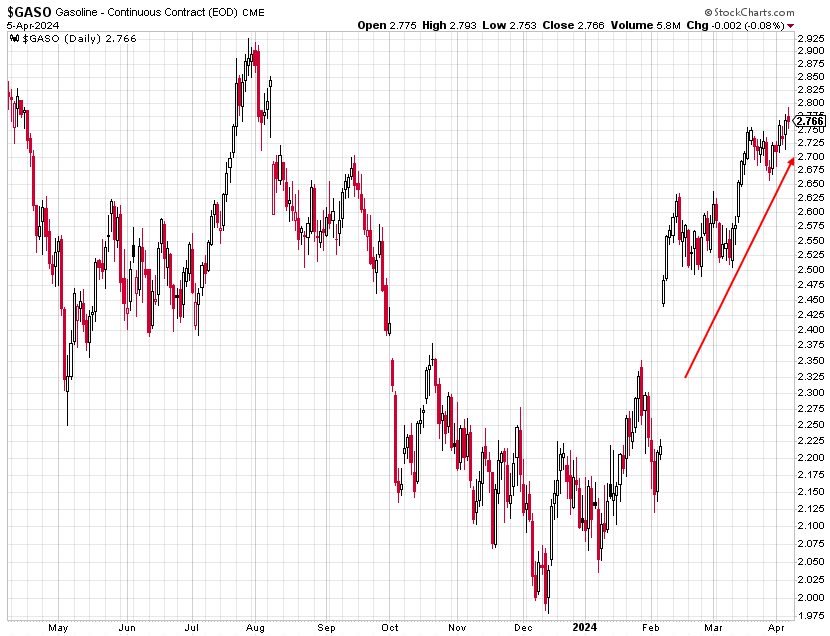

U.S. wholesale gasoline prices have spiked by approximately 30% in the past two months and are one of the most psychologically important and visible indicators of inflation in the minds of everyday consumers:

Gold is Benefiting From Political Uncertainty

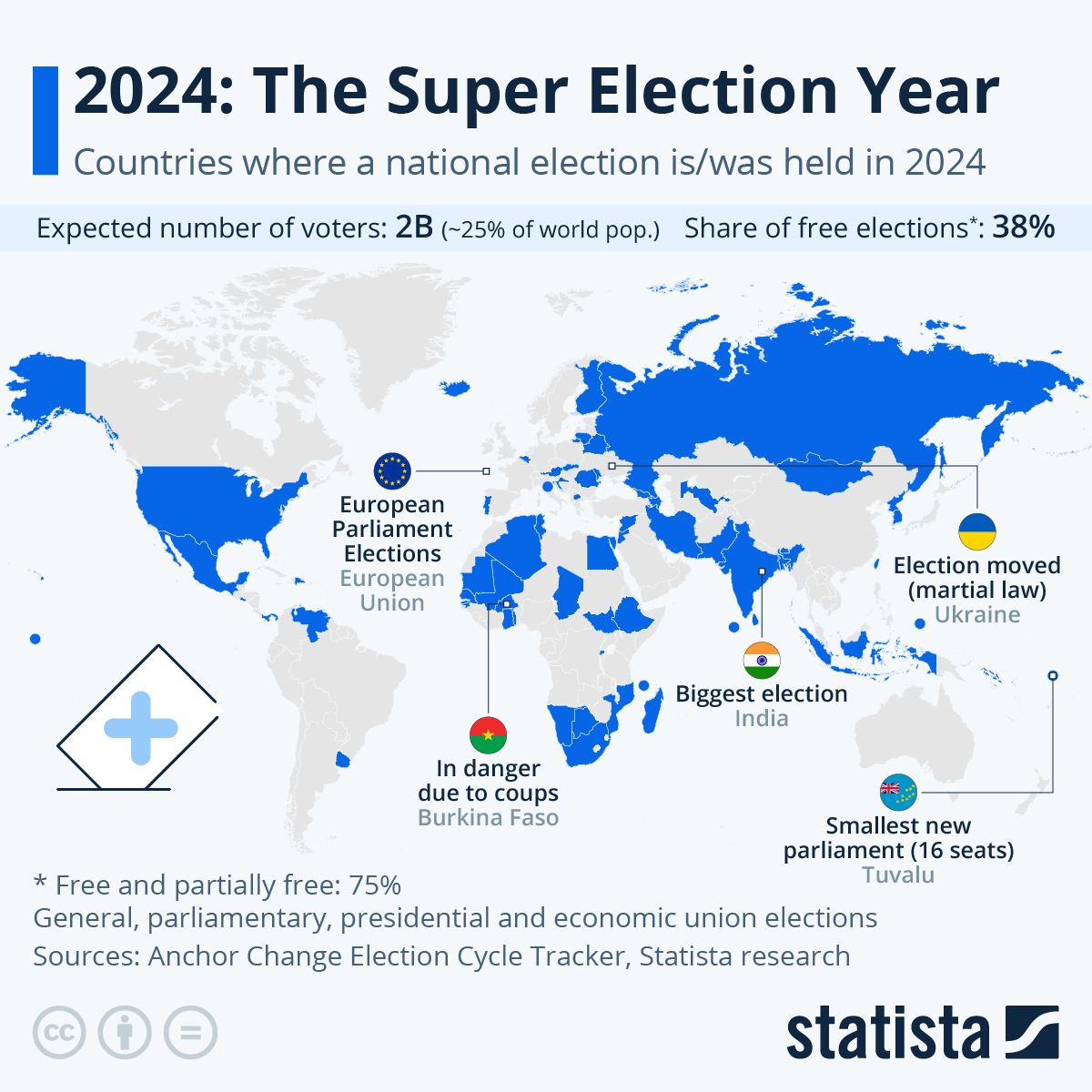

In addition to being a hedge against inflation, gold is also a hedge against economic and political uncertainty. In 2024, more than 60 countries are set to hold national elections, which makes it one of the most active global election years in a very long time, earning it the moniker “The Super Election Year." The United States, Mexico, India and Indonesia are just some of the countries that are holding national elections this year.

Economic issues, including inflation, are the top concern for Americans who will most likely choose either President Joe Biden or former President Donald Trump to be the next U.S. president in a redux of the hotly-contested 2020 presidential election. President Joe Biden and the Democratic Party have earned a reputation for heavy spending and racking up the national debt, which are major reasons why they are blamed for the United States’ inflation problem. Based on that view, a potential Biden win would be beneficial for the price of gold.

How Geopolitical Tensions Are Helping Gold

As if there were not enough uncertainty and confusing cross-currents in the world already, rising geopolitical tensions in a number of hot-spots are also helping to boost the price of gold. The Russia-Ukraine war has taken a turn for the worse recently after Russia shot down 53 Ukrainian drones and the Kremlin warned that Russia and NATO are now in “direct confrontation.” Ukraine claimed that it destroyed least 6 Russian fighter jets, damaged eight more, and killed or injured 20 service personnel.

In addition, the Israel-Hamas war has now reached the six-month mark and shows no signs of de-escalation. On the contrary, Iran is now increasingly involved in the fray after Israel struck numerous Iran-backed targets in Syria, which has now resulted in Iran vowing to retaliate, which is putting the world on edge and supporting the price of gold and crude oil.

(Our documentary, “Gold in Times of Crisis Ep 1 – Passage out of Vietnam” highlights the importance of holding gold in times of geopolitical uncertainty.)

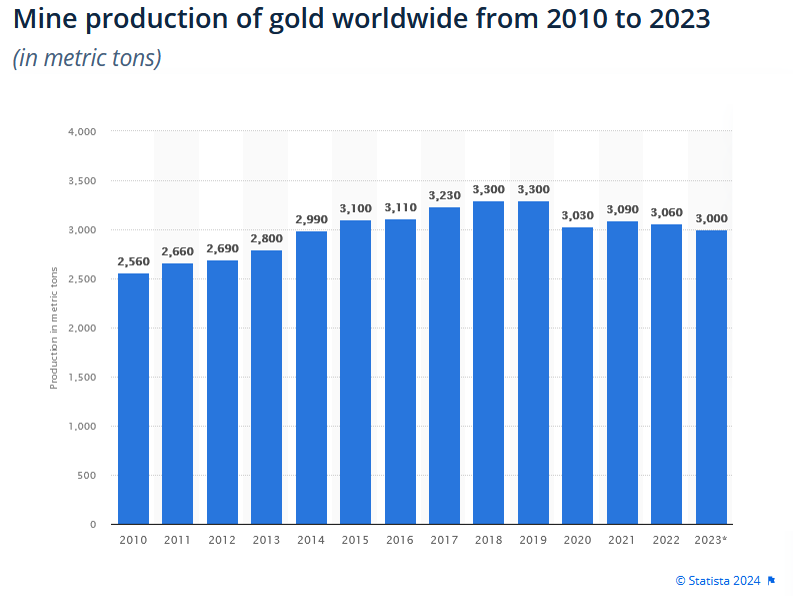

How Declining Production Supports the Price of Gold

Another factor that is supporting the price of gold is the stagnating and declining production of gold from mines around the world. After rising steadily each year since 2010, global gold production peaked in 2019 at 3,300 metric tons and has since been declining even as the price of gold rocketed 66% from $1,200 to roughly $2,000 in 2023. Many experts believe that the world reached “peak gold" in 2018, which means that the amount of economically viable gold deposits around the world has peaked and entered into a terminal decline. Supporting that theory is the US Geological Survey’s alarming estimate that all known gold reserves could be depleted in just seventeen years.

Why You Should Invest in Gold

As I’ve discussed in this piece, gold is in a confirmed uptrend and there are numerous factors that are driving that uptrend. To learn more about the additional monetary and fiscal factors that are driving gold’s bull market, I recommend taking a look at my other recent piece, “What You Need to Know About Gold’s Long-Term Bull Market." To summarize, gold is rising in response to the alarming debasement of paper currencies and the ballooning global debt burden that guarantees a serious currency crisis in the not-too-distant future.

While many of today’s most popular financial products are only a few decades old at most and the average lifespan of a fiat currency is measured in mere decades, gold has helped humans preserve their wealth from all sorts of fiscal and monetary shenanigans perpetrated by governments for at least six-thousand years. Though we live in a highly complex world that is increasingly dependent on technology (and likely too dependent on technology), the simplicity of physical gold is one of its many strong points — especially when complex systems experience upheaval and failure.

There are countless modern investment products that aim to help investors gain exposure to gold, but most of those are “fool’s gold" rather than the real deal. There are gold exchange-traded funds (ETFs), gold futures and options, contract for differences (CFDs), other derivatives, and gold mining shares, but those are just paper claims on gold instead of actual gold that you hold free and clear. In times of serious crisis and chaos, as I expect we are heading into, there is no substitute for physical gold bullion that is in your possession and completely unencumbered by any other claims.

If you’d like to protect and diversify your hard-earned wealth in this era of tremendous risk and uncertainty, please take a look at our wide assortment of gold, silver, and platinum bullion products that are offered at some of the lowest prices in the industry:

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Why a Powerful Silver Bull Market May Be Ahead

Why a Powerful Silver Bull Market May Be Ahead

What’s Driving Gold to All-Time Highs?

What’s Driving Gold to All-Time Highs?

What You Need to Know About Gold's Long-Term Bull Market

What You Need to Know About Gold's Long-Term Bull Market

BullionStar Financials FY 2023 – Year in Review

BullionStar Financials FY 2023 – Year in Review

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

BullionStar

BullionStar 3 Comments

3 Comments